A new feature on Think-Thread, the Market Mind series is going to be a monthly piece on my opinions and projections for all things financial. Financial markets are discounting mechanisms – meaning the markets themselves are a “wisdom of the crowd” prediction about what is going to happen in the future. This prediction has massive real-world implications. More importantly – to the extent we have reason to believe these predictions are wrong we can profit from the misalignment between markets and reality.

The best and most relevant example of this is the current COVID-19 outbreak. I’ll be doing an entire series diving deep into this pandemic (yeah, I said it) over the next few weeks. I’ve been following COVID-19 for months. Here is a facebook post I put out to give friends and family a warning about COVID-19 before it even had a name:

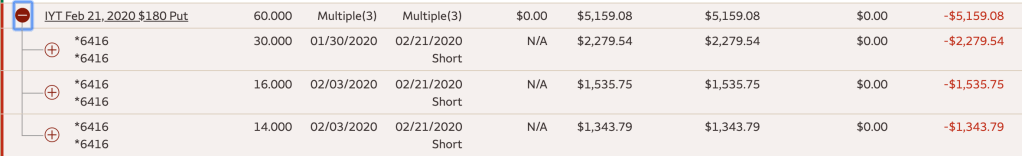

You would think with this kind of foresight I’d have made a killing in the 14% selloff that was only weeks away. You’d be half-right. The day I made that post I purchased insurance on my portfolio buying puts on the IYT ETF that tracks transports, anticipating airlines to be the hardest hit and with puts being very inexpensive on a diversified ETF of this type. I would add to the position over the next week. Here is how that trade worked out:

My 60 puts all expired worthless on Feb 21 with the IYT at $195. So much for insight turning into profit. Over the next 15 trading days IYT would fall over $30 to where it sits now at $161, with more downside undoubtedly on the way. Those 60 puts, taken out at a more distant strike, would have been marginally more expensive to buy, but would now be worth over $120,000. So when I say I was early… I was really early.

But unlike the old adage – I would contest I wasn’t wrong. When you have the strength of your convictions, taking losses in stride is much easier and making clear headed decisions much more straightforward. The Monday that the first round of IYT puts expired worthless it was clear the market was waking up to its underestimation of the impacts of COVID-19. I moved into all defensive positions (as described below) and added a new round of longer-dated puts for more protection. Some in the form of additional IYT puts, but even more on travel and leisure companies like WYNN, MAR and simply the SPY. Finally, given some insight from a good friend with ties to oil and gas, I took out protection on FANG energy as a company with some real underlying debt issues that would be devastating if oil fell below $50 per barrel. Needless to say I more than recovered my losses on IYT. I did not come anywhere near the return I would have realized with only slightly more humility and better timing on my original pre-COVID-19 bets.

There was a great lesson to be learned here. When you have insight that you know the market isn’t pricing in – exponential growth of an existential threat while the markets are making new highs, for example – do not underestimate how long it will take the market to figure out and account for the underlying uncertainty.

In 2008, the first crisis I had to navigate where I was responsible for any substantial amount of money, I became defensive quite early, limiting my max losses to 15-20% across accounts for the year (which, amazingly, counted as outperformance during those dark days). Unfortunately at that time I never even considered trying to profit from the calamity. Call it a valuable lesson learned. With COVID-19 I similarly saw the writing on the wall earlier than the market and went defensive prior to the selloff. But this time around I recognized an opportunity to cash in on the market complacency with a little speculation. My execution wasn’t perfect, however, causing what should be huge gains to instead be just modest. This still represents solid outperformance – being up 10% while the market is off 15% is nothing to sneeze at (sorry, bad pun). But it still feels like the sort of insight I had was worth much more than I ended up making out of it.

At any rate – hindsight is 20/20. The markets are now clearly in correction territory. The air has been taken out of all the travel and leisure stocks. The cruise stocks are off 50% from their highs. The VIX (a measure of stock market volatility) is up hundreds of percent over the past 15 days. Despite puts being much more expensive, everyone is buying them now, and in the most obvious of names. Adding additional put protection is very expensive, particularly in names who are already massively oversold. COVID-19 is undoubtedly spreading worldwide and the US will not be spared. What can we expect to happen the rest of this month and moving forward, and how am I positioning my investments?

In terms of high level events – I feel intuitively that market participants have not fully priced in wide-spread US and worldwide contagion. There are still people in the markets who believe the virus can be contained without wide-spread quarantines or other draconian measures which would cause extreme short term disruptions in the US economy. President Trump and his advisors are publicly telling people to buy into the stock market, reiterating that there is nothing to worry about, that we should continue to travel, shop, consume – anything other than stay inside. All the while conferences are being cancelled. Washington state, a hot spot in the US, has shuttered its boutique coffee shops and stores. New York city has closed schools, Austin TX has cancelled the countries largest music and tech festival SXSW. Hundreds of other business conferences and conventions across the United States have been cancelled or postponed.

Is this an overreaction? We still have fewer than 500 cases in the US as of this writing (Sunday March 8th). Markets have certainly priced in something – but is a 14% selloff from all-time highs the correct reaction? Are there other at-risk sectors or companies that have not been appropriately priced that this time? Where are the opportunities to buy for the longer term?

A few bearish trends I think will play out over the course of March:

- Test kits have been slow to be delivered and deployed, and CDC guidelines have been fairly restrictive in terms of who deserves to be tested. That has recently changed. Over the next two weeks hundreds of thousands of kits will be deployed and test results verified – meaning the case count will more accurately reflect the rate of underlying disease. By the end of March and in the absence of draconian measures I expect the count of COVID-19 cases in the US to easily cross 2,000 and potentially be as high as 20,000. The rate of growth will be over-blown as much of the growth will be from increased testing, not necessarily increased infection – an important point for understanding future market trajectory after this period of increased testing subsides.

- Areas of mass gathering and public interaction will suffer, particularly in effected urban areas. Small businesses that are well capitalized will be fine, but many coffee shops, restaurants and boutique stores will struggle with lower traffic and sales. This is particularly true for companies without an online presence. This trend may result in layoffs, which could increase the fear of recession in the US.

- In terms of monetary response and the bond markets – the Fed will probably cut rates yet again (following their emergency 0.5 basis point cut last week – which did very little to quell market fears and potentially exacerbated the panic). Continued pressure on US treasuries may threaten to take yields negative with unforeseeable consequences for banking and finance. In this rare instance I think low rates present a risk to the economy itself – it’s really hard to comprehend what a negative risk-free rate does to anyone trying to do discounted cash flow analysis (i.e. value investors and/or banks).

- Event cancellations will continue – SXSW is just one in a string of high-profile cancellations that will likely happen. The NCAA March Madness tournament may play to empty seats at first. As COVID spreads I could see the later rounds of the tournament being suspended or cancelled entirely. Same is true for the Olympics, scheduled to take place later this year in Japan.

But it’s not all doom and gloom. On the plus side are the following factors to weigh:

- The market is 14% cheaper than it was just a short while ago. By itself this is a compelling argument for buying equities in the longer term.

- Interest rates are all time lows. There are zero returns to be had from buying treasuries or other like assets here. Again – massively positive for equities, although potentially problematic for the longer-term economy.

- Trump is still the President. His ego and re-election hopes are pinned to market performance. For better or worse Trump may approve fiscal stimulus to float crucial infrastructure like airlines and hotels through the outbreak. This may extend to less crucial companies like cruise lines and theme parks as well – although the case for supporting these less crucial industries is weaker. If layoffs start to happen in small businesses expect some sort of fiscal response there, as well.

- Summer is coming. Just yesterday I analyzed the spread patterns of COVID-19 vs average temperature of the country in question – the relationship is pretty clear. Like other coronaviruses I think it’s looking increasingly likely that this one, too, struggles to spread in warmer climates. Recent research out of China tentatively backs up this notion.

- The fatality rate is really low, and probably going to drop as more tests discover milder cases. This is especially true for countries whose healthcare systems are modern, amongst non-smoking populations, and younger, healthier demographics.

So… what am I doing this month?

First off – I’m generally a long-term bull. Being short the stock market for any extended period of time is a bad idea, I don’t care how much insight you have. Wealth is being created all the time, and the equity markets are the only place where an average citizen can participate in that wealth creation. Stocks really are the best game in town. If you aren’t trading around your positions and are just a diversified long-only investor – I would not recommend adjusting your holdings now.

From the long-side my largest holding which I will continue to add to is Service Corporation International (SCI). This is the largest publicly traded funeral / cremation company in North America. As morbid as it sounds, this company only stands to benefit should we see widespread infection resulting in death in the US and Canada. Unlike other more obvious COVID-19 beneficiaries SCI hasn’t been as aggressively bid up… yet.

Back in 2018, in the search for some biotech exposure, I discovered MRNA as a best-in-class speculative option. Their talent and technology stood out as head and shoulders above the competition. Amazingly (really just dumb luck, I suppose) MRNA was the first company to have a COVID-19 vaccine ready for human trials – going from a digital copy of the viral DNA to a vaccine ready for human trials in an astounding 42 days (amazing). The stock has been bid up here accordingly, and despite trading around the position, I’m still long MRNA. If this vaccine works it demonstrates a capacity for rapid development that other pharma companies and biotechs can only dream of.

During the selloff off I’ve been accumulating a few names as longer-term holdings including DIS, HD, VZ, STZ and GS. Some positions I’ve held for some time and have been adding to (VZ and STZ) while others I am opening new positions in on account of the panic (HD, DIS and GS). On Friday RCL sold off 18% in the session and (gasp) I dipped my toe in those murky waters for the first time. I would not recommend that trade for the faint of heart.

The idea here is that at some point COVID-19 goes away. I don’t think humanity has taken their last cruise or visited their final amusement park. DIS also has the #2 streaming platform in the US with Disney + that can dampen the damage from losses sustained in the short term on their theme parks. VZ and HD are two different ways to play historically low yields on US treasuries. For VZ, the over 4% yield is extraordinarily safe – and the lower rates go the more investors will flow into this high quality name to capture the yield. Additionally this is a 5G play… on the other side of the COVID-19 crisis people will start talking about the 5G megacycle once again. HD will benefit from record home refinances as a result of generationally low mortgage / refi rates. US home owners have an estimated $6 trillion in untapped home equity. Refinancing often funds home-improvement projects which is HD’s sweet spot. More people staying home / working from home will only accelerate the demand for home improvement.

In terms of the broader housing market, I think low interest rates will further exacerbate the housing shortage in this country. I’ve been debating if I should press ahead with a home purchase I begun right in the face of the COVID-19 scare as rates became epically low. As the disease spreads I still can’t talk myself out of buying this property. The housing market only suffers here in the absolute worst-case scenario where COVID-19 causes a protracted, deep recession in the US. Without a recession supply will remain tight and demand will remain strong. I just don’t see a huge downside for popular markets like Portland (where I live now), Austin (where I lived last year) and Boise (where I bought my first property 9 years ago during the financial crisis). The outbreak in China only tightens home-building supplies in the short term, making it more difficult to bring new homes online.

That said – if you can afford the down payment I would not be afraid to buy a house during this scare. This is particularly true if you can afford a home that has income-potential in the way of an AirBnB or ADU.

What am I shorting here?

Despite covering half my puts at the end of last week, I’m still quite negative on WYNN and will add to those puts on a rally (the selling had just gotten really quite steep here). Casinos in general are not where you want to be when you’re sick or afraid of getting sick. Independent of COVID-19, WYNN faces several secular headwinds. AirBnB is taking hotel traffic. The move towards legalized online-gaming threatens in-person casino revenues. When more cases show up in Vegas I expect WYNN to be hit even harder. If March Madness and other sports events are cancelled the damage to WYNN will be severe.

Finally – I covered my small put position on FANG last week, probably way too soon to be honest. But if you don’t take off some of your protection when a position is down 18%+ in a day, you’re probably being piggish. Oil and gas is particularly exposed here with many operators having large debt positions that they simply cannot cover in a $45 per barrel oil environment. On any rally I’m looking to re-establish put positions on FANG. Again, here, oil and gas was in secular decline before COVID-19 was a household name.

Moving forward into some dicier / off the radar plays… I think the next leg of the crises is likely to effect small businesses and restaurants many of which are already operating on thin margins. One tradable angle here is Red Robin (RRGB) – this company is already in decline and probably cannot handle a huge reduction in traffic over the next few months.

Less directly tradable are the 10,000’s of small stores nation wide that cannot afford even a momentary blip in traffic. Obviously most of these are not publicly traded – but there is a very sneaky way to play this next leg that I’m considering putting on right here: Square (SQ).

Square is the payment option for most small businesses these days and is lauded as a massive growth story on Wall Street. It’s sort of a market darling. Over the last 18 months Square has started extending lines of credit to the many restauranteurs that use their services – what they’ve dubbed ‘micro-loans’. This untested business model will potentially face its first downturn right here and – if COVID-19 causes wide-spread self-quarantines in this country – what was once a brilliant idea could go dramatically sideways leaving Square on the hook for credit extended to thousands of mom-and-pop restaurants that simply have to shut their doors. Perhaps the most compelling reason for a short here is that no one is paying attention to it… yet. Square is trading higher now than it was a month ago – feeling almost no pain from the outbreak-induced panic. What’s worse Square has an absentee CEO Jack Dorsey who spends half his time dealing with Twitter and plans on spending half the year next year in Africa. The magic of Dorsey is wearing thin here, an additional potential downside catalyst for Square.

That’s all for now. I’ll check back next month to see how these prognostications have fared and update my view moving forward.

1 thought on “Market Mind: March 2020”

Comments are closed.