I wanted to make a quick post to start next week. The situation with COVID-19 is changing rapidly, as expected. The world has now woken up to the real threat posed by the SARS-2 virus. As a result aggressive actions are being taken in the US and abroad.

Italy – the new epicenter of the crisis – has been locked down entirely. Italy is the template for how COVID-19 management can go awry. They were very late to test for the virus – only really started testing when many deaths had already been recorded. By then it was too late. Case counts began escalating by the 1,000’s daily, death counts followed suit on about a 10-day lag. Today Italy announced 3,590 new cases and 368 new deaths. Their healthcare system is being overrun. There are nightmarish videos of people locked in their homes with dead siblings. It’s terrible and my heart goes out to that country.

The light at the end of the tunnel in the Italy case is that the country has already been in complete lockdown for 5 days, regional lockdown for 7. While deaths jumped by their largest single-day percentage today (up from 175 deaths yesterday, a more than 100% increase), the case count only increased from 3,497 the day before, or a 2.7% increase. With a maximum 14 day incubation period, it’s reasonable to expect that cases will peak in the next few days. The virus is reported to be maximally fatal 10 days after the onset of symptoms – so the death count could continue to increase for a short while after the case count peaks. Complications in providing care due to a crush of patience requiring intensive are and a lack of healthcare providers and resources will obviously make the situation worse. But in the next 3-5 days we should see the peak of Italian daily new cases with peak deaths coming 3-4 days thereafter. Again – my thoughts go out to everyone in Italy dealing with what truly is a humanitarian crisis. The healthcare workers risking their lives to save others are the true heroes in this thing.

Again, how did Italy get this way? “They were very late to test for the virus – only really started testing when many deaths had already been recorded. By then it was too late.” Sound familiar? I’m afraid that the US right now is on the same trajectory as Italy was roughly at the end of February, and potentially the spread here is worse (the average American travels more than the average Italian – facilitating spread). Fortunately our demographics are better – the median age in the US is 8-9 years younger.

My belief is that the average US citizen is adopting best practices which will dramatically reduce the spread of COVID-19. This reduction won’t be as pronounced as a full-scale lockdown, which is still not out of the question, but I think over the next few days we will see wide-scale adoption of social distancing and self-isolation for anyone expressing symptoms. Almost all sports events have been cancelled, almost all large-scale gatherings have been banned. Most companies that can afford it are forcing individuals to work from home. I think it’s safe to say many of the most important measures to reduce mass spread of COVID-19 are in place right now – though lockdowns, cancellations of domestic travel, and other local precautions will further reduce spread.

The implication is that while the US will see a huge spike in cases and a rolling increase in deaths over the next 2 weeks, I am expecting cases to peak around sometime in mid-to-late April and decline thereafter. It’s going to be bad between now and then, but we will see the other side of this.

That is an outline of how I see the human / health side playing out. Grim in the short term, but ultimately hopeful – the end is nigh (and not in the way many of you might be thinking). The overall toll of this disease may fall short of other outbreaks like H1N1 exactly because of worldwide aggressive action commensurate with the threat. Left to spread unabated the damage from COVID-19 would be logarithmically worse than H1N1. These lockdowns and precautionary measures are literally saving millions of human lives, and in that regard they are a triumph.

But they have real financial costs. On that front – on Friday the Federal Reserve promised $1.5 trillion in liquidity to help keep markets operating smoothly. President Trump announced several aggressive actions to thwart the spread of the virus and mitigate the financial impact to both corporations and individuals. Nanci Pelosi created a bill in the House to provide sweeping aid that focuses on those most likely to be damaged by the economic fallout of the virus. That bill was passed quickly by the Senate at the behest of the President.

These are very encouraging and dramatic efforts to help people and companies outlast the virus. It’s incredibly uplifting to see American politicians put their in-fighting aside and rise to the occasion here. I do think the administration deserves a lot of criticism – the delay in serious action (prepping tests, for example – the most basic and important part of understanding and containing the spread) is directly responsible the coming American fallout. But there will be plenty of time to lay blame when the crisis subsides. This weekend the American apparatus worked as it should, all pulling in the same direction to get us through this.

Then, Sunday night, the Fed announced that it was slashing the fed funds rate to a range between 0-0.25% for the first time in US history. The Fed also announced it was once again engaging in quantitative easing (QE) with a war-chest of $700 billion to be used to purchase treasuries and mortgage backed securities.

In response to the entire mosaic of the above news – stock market futures limited down (the maximum losses in futures is 5%) Sunday night.

I wanted to post tonight before the markets open tomorrow morning to try and put all of this in context. In terms of the disease, my best estimation is that the US outbreak peaks in 4 weeks. The US government has demonstrated that it will not allow companies or individuals to fail or starve in this period – that’s wonderful and puts a cap on the maximal downside in terms of lives, jobs, bankruptcies and S&P500 points. This is going to be bad, potentially really bad. But as of this weekend we are taking it seriously and reacting accordingly. I’m not a red-blooded ‘Merica type – but I am both conscious and proud of the American tradition of rising to the challenge. The President is wisely leveraging our free-market leaders, asking them to sacrifice now for the country that has given them so much, and it appears as if they are all on board. In a crisis I simply wouldn’t bet against America. Historically it’s been a losing bet.

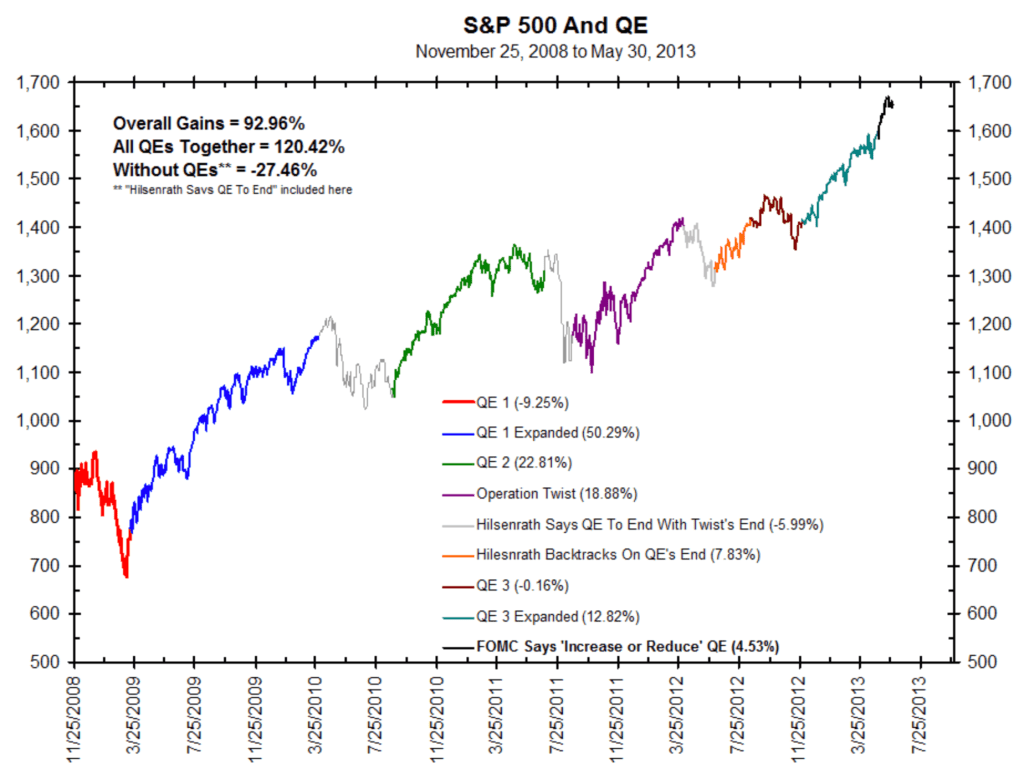

In terms of financial markets – I think this moment warrants particular commentary. I wont go into what QE is, but I do want to note what it means. To put this extreme measure in context, take a look at this chart of stock market returns during historical periods of Fed QE action:

I felt like we were approaching a bottom in the markets on Thursday down 10% in a single session and covered my short positions accordingly. The 10% rebound felt a little too enthusiastic so I put some small short positions back on. This QE news, in my eyes, can mean only one thing – cover your shorts at the next available opportunity and slowly leg into the markets as case counts continue to rise and we approach the peak. The old market adage is even more reliable when QE is going on in the background: don’t fight the fed.

1 thought on “Market Minute: March 15”

Comments are closed.