Last week saw the largest stock market rally since 1938. The indexes finished the week up nearly 20% from the lows recorded on Monday. The Fed has promised ‘infinity QE‘ and the federal government passed the largest fiscal stimulus package in US history. We had a record unemployment number of 3.3 million reported Thursday. In the background, SARS 2 COV virus continues to burn through Italy, Spain and France. Now New York and the United States have become the epicenter of the outbreak. What happens next?

In many ways this weekend is the most confusing point since the crisis started in terms of understanding and anticipating the future of financial markets. It’s hard to know what, exactly, is priced in. This is the definition of a black swan – there is no method or equation to model likely outcomes from here, and that uncertainty needs to be respected. What is the appropriate calculus, here? We are all trying to solve this impossible equation:

($2T stimulus + infinity QE) – (Economic Shutdown + 10’s or 100’s of thousands dead) = ????

Anyone claiming to know with certainty what comes next is delusional. Most of the talking heads I heard this week were calling for a retest of the S&P500 lows. Some are expecting markets to break through those lows before we reach a bottom. A few proclaiming this will be worse than the Great Depression. On the other hand a brave few are insisting that Monday’s intraday low of 2,191.86 represent the bottom and are piling in right here (from what I can tell they tend to be piling in only after the 20% run-up for the week)… so which is it?

The truth, as always, is complicated. We don’t know. No one knows. The Federal Reserve’s actions have taken off the table the prospect of cascading bankruptcies of major institutions or banks. For the time-being the credit markets are acting relatively normal again. The $2T fiscal stimulus package represents about 1/10th of America’s nearly $20T annual GDP – so it’s at once big and, probably, not enough. With any luck the loan forgiveness program may save a non-trivial portion of small businesses who would otherwise be forced to lay off their workforce. Direct payments to individuals and families will be a much needed shot in the arm to the US consumer.

While these are important and encouraging developments, what we really need is a literal shot in the arm – a vaccine or therapeutics to help fight back against COVID-19. Always keep in mind that the outbreak is the cause of the crash and, while the government can try to mitigate the damage, the future trajectory of the markets will remain bound with that of the outbreak. The markets will bottom before the virus peaks – but they won’t bottom until we at least have the ability to produce reasonable estimates of when the virus peak will occur.

And to be clear – we can’t really estimate that, yet. Can people be reinfected? What is the risk of mutation? How many asymptomatic carriers are in the US? Will the vaccine work? How about therapeutics? We have ideas and estimates on each of these – but nothing approaching clarity. As the weeks unfold and we will get news on all these fronts and the markets will price that data in appropriately. Figure out the virus and you figure out the markets.

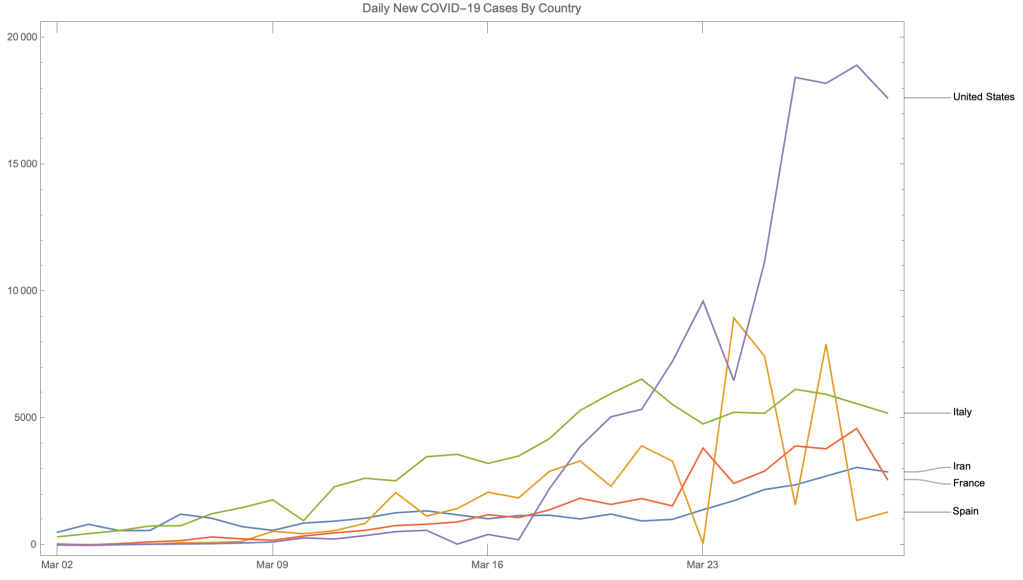

I had been predicting (hoping?) new Italian cases would peak on Monday or Tuesday of last week. While that may indeed have been the peak in their daily new case count, there hasn’t been a significant drop-off from that peak. The climb has been much faster than the fall, unfortunately.

The chart above (built from data at BNO news) shows two things quite clearly. The first is that Italy’s “peak” is more of a plateu as mentioned above. The second – most important for markets in the coming week – is that the US has a serious problem. By most expert accounts the US is a few weeks behind Italy. Of course the US population is almost 6 times that of Italy, but already we are seeing 3-5 times the number of new cases, daily.

While the US response is ramping up it is both too slow and underwhelming in terms of actual results. There are already reports of ventilator shortages in New York and the worst is almost certainly yet to come. I can’t imagine how markets will react when, sometime in the next few weeks, a thousand American deaths are reported in a single day. How about when our case count crosses a quarter million in early or mid April? If the federal response remains underwhelming and social distancing measures are not taken seriously we could see 10’s of thousands of deaths being reported daily by mid May… how will those headlines play out? We are still operating with some dramatic uncertainties here.

What is clear is that, in the worst-case scenario, markets are nowhere near making a bottom.

I don’t think this is the most likely scenario- but it’s important to keep in mind that it’s not an impossible scenario. No matter how oversold we were going into last week – a market rallying 20% in 3 days is not a market that’s taking these worst-case downside scenarios seriously. For this reason, I took the run-up as an opportunity to reposition my puts to have a mid-May duration and incrementally added to them each up day last week. If I’m forced to choose I suppose I’m in the ‘retest’ camp.

At the very least I think this next two-week period will be very volatile for equity markets. If you missed the bottom last Monday I wouldn’t have recommended chasing as markets ran higher – I think you’ll get at least a partial retracement here to leg into.

Under normal circumstances I’m an advocate of owning broad market indexes. But with COVID-19 it’s fairly clear who will be the winners and losers. I continue to avoid airlines, travel stocks and associated ETFs – though I no longer think these companies are suitable for buying puts against given how oversold they became and the government backstop. If you are buying puts to protect long positions I’d target companies with potential credit risk, those who are in the direct blast radius of COVID-19 fallout, and – importantly – are currently left out of the federal giveaway.

Given the impact on small businesses I had been using puts on SQ to protect my long positions on the way down, selling during every major panic and buying back on any (rare) rebounds. There is some talk that SQ will be involved in delivering direct payments to the consumers via CashApp- but I think this is upside catalyst isn’t likely. Without that, I can’t see SQ – still priced as a growth stock at P/E of 65 – catching up to its multiple anytime soon. While the bailout may keep small businesses afloat it will not increase foot traffic or transactions. What’s worse the government loans will be supplanting SQ’s profitable lending business. Even with the government’s lending facility some small businesses will simply shutter their doors indefinitely without repaying the short-term loans they recieved from SQ prior to the shutdown. SQ may see a hit to their balance sheet as a result (earnings are in early May).

I think we are destined to hear more horror stories of senior and assisted living centers being infected; Ventas (VTR) seems an appropriate vehicle for getting short this space. Finally Diamondback Energy (FANG) has higher than average costs of production and simply cannot stay solvent at these depressed oil prices.

My reservation on all of these names is that they’ve already experienced massive declines – so value hunters may keep them afloat. It’s much harder to get short after the market is down 25% and all eyes are on the virus.

My long positions remain more or less the same:

- Lower risk: PGX, VZ, AMZN

- Mid-risk: HD, NVDA, DIS, GOOG, TOT, STZ

- Higher risk: MRNA, INMD

Notes: GLD stands to benefit from all of this liquidity and currency debasing. I hold GLD and GOLD as my preferred gold miner. And SCI, the largest publicly traded funeral and cremation provider in North America, is no longer included in my long positions as Washington State has banned funerals and I expect the other states to follow suit. SCI was a great example of a decent thesis going wrong. It happens.

I’m looking forward to time when it is no longer necessary to play both sides of the market (or hold massive cash position). Unfortunately we aren’t there yet – this run up was a great opportunity to reposition. If we are to retest the lows I expect the move to start slower than the original selloff but to culminate in capitulatory acceleration, after which we can start to regain our footing for real, for the longer term. But it can’t happen until we get clarity on the virus – for bettor or worse. This negative outlook could be changed instantly with a breakthrough in therapeutics that dramatically reduces the need for hospitalization.

Until that time I’m staying beta-neutral, selling my puts against at-risk firms and accumulating quality companies during the inevitable panics and re-establishing / re-dating my downside protection on the rebounds.