March 2020 was one of the most unfathomable months in modern history. In the March Market Mind piece I tried to outline how I thought the still mostly nascent COVID-19 outbreak would impact America. At that time the outbreak had not been labeled a pandemic by any major health organization. In the US there were fewer than 500 cases. Some municipalities had closed schools and cancelled large events and markets had sold off 14% from the all time highs reached just a few weeks earlier.

While I don’t want to dwell on the past – I think it’s important to accurately assess my own thought process in a post-mortem fashion. I made several predictions in that post. In retrospect some look rather quaint…

By the end of March and in the absence of draconian measures I expect the count of COVID-19 cases in the US to easily cross 2,000 and potentially be as high as 20,000…

At the time of that writing, these were fairly dire predictions. Only China had more than 10,000 cases. I thought, naively, that I was being bold. As it turns out – even data scientists who should know better underestimate exponential growth. By the end of March the case count in the US had surpassed 200,000. I was off by a factor of 10.

Other notable calls include the pressure on small and local businesses, the likelihood of recession, the Fed cutting rates to 0 and the mass cancellation of events including specifically the NCAA tournament and the Olympics.

Lastly, I predicted that death rates would fall as the disease spread to western countries. Unfortunately the exact opposite held true – a terrible reality in most of Europe and, increasingly, the United States.

Amid all this turmoil markets extended their February losses, finally bottoming Monday March 23rd hitting a low of 2,191.86 on the S&P500 – off more than 35% from prior highs. Since then we’ve experience an increasingly massive policy response from central banks and the passage of a $2 trillion fiscal stimulus package. These actions have sparked a 20% rally despite cases and deaths continuing to rise and accelerating economic fallout on account of a government mandated shutdown.

So where do we go from here?

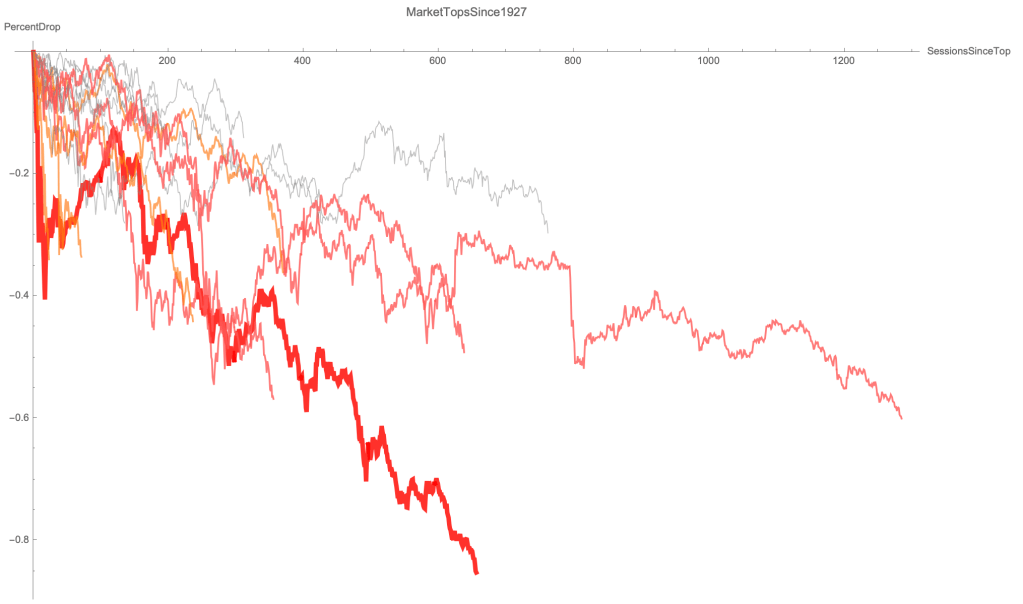

From a pure market movement perspective I’m hearing a lot of comparison between this modern crisis and the Great Depression. This a critical comparison because if this crisis looks anything like the Great Depression we are nowhere near the bottom in terms of financial markets. The plot below shows selloffs as a % from any 1,000 day high in the S&P 500 since 1929:

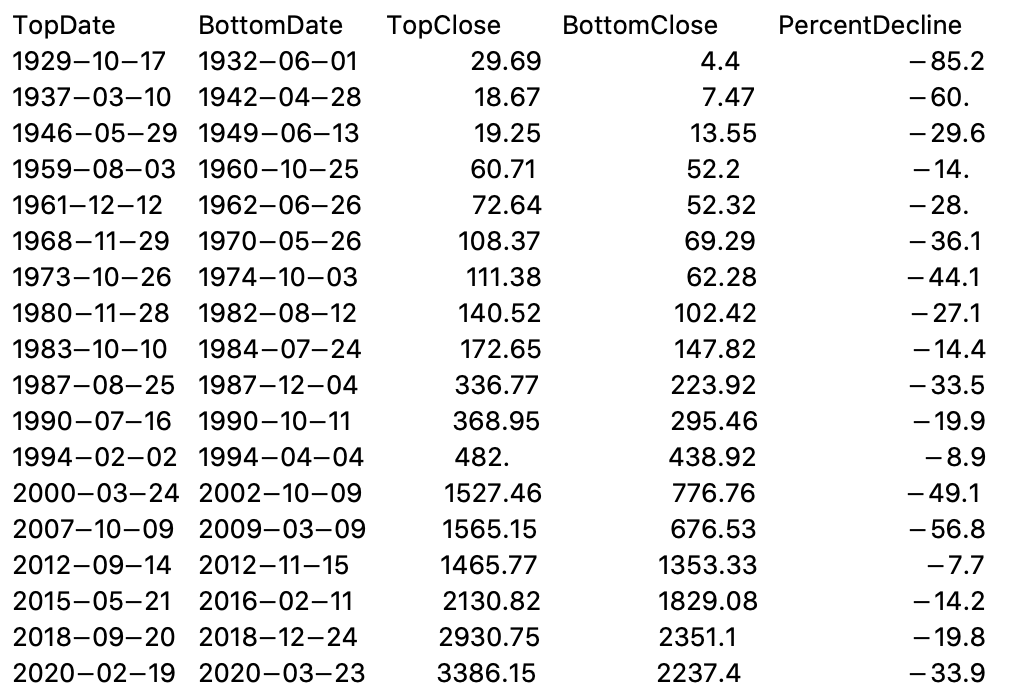

There are 18 periods included. A summary of the selloffs shows just how dramatic the Great Depression was compared to all other market selloffs in history:

There have been 5 market tops in history where markets fell 40% or more before bottoming. While all of these were painful, The Great Depression is by far the most dramatic. Over a period of 3 years markets lost 85% of their value. Could COVID-19 spark the Great Depression round 2?

Obviously no one knows how this will play out. I’ve been more negative than most to date – I think we consistently underestimated this virus until late March. Today, however – all eyes are focused on the health and economic fallout from this virus and the US government is pulling out all the stops. We now have record low interest rates, a Fed that’s promised infinite liquidity (even purchasing junk and muni bonds, an unprecedented step announced Thursday) and a $2T stimulus package.

The human health picture is also increasingly promising. The scramble to generate supplies has left us with a surplus. The mandatory lockdown – a weapon of economic mass destruction – and the worldwide embrace of social distancing has thwarted COVID-19’s spread. Case and death counts worldwide appear to be plateauing. Therapeutics may be on the way and several vaccine candidates are undergoing human trials.

At the same time unemployment is at record highs on account of the mandatory shutdown and this outbreak is by far the worst global human health crisis since the 1918 Spanish Flu pandemic. The visualizations demonstrating these two unfortunate realities are impressive and horrifying.

This is my favorite animation of COVID-19 deaths vs other outbreaks, and this is my favorite animation showing what over 6 million jobless claims in a week looks like on a graph. Yikes.

I can’t say for certain what needs to be true for a Great Depression scenario to play out today. But I think it’s valuable to provide some context… just how bad was the Great Depression?

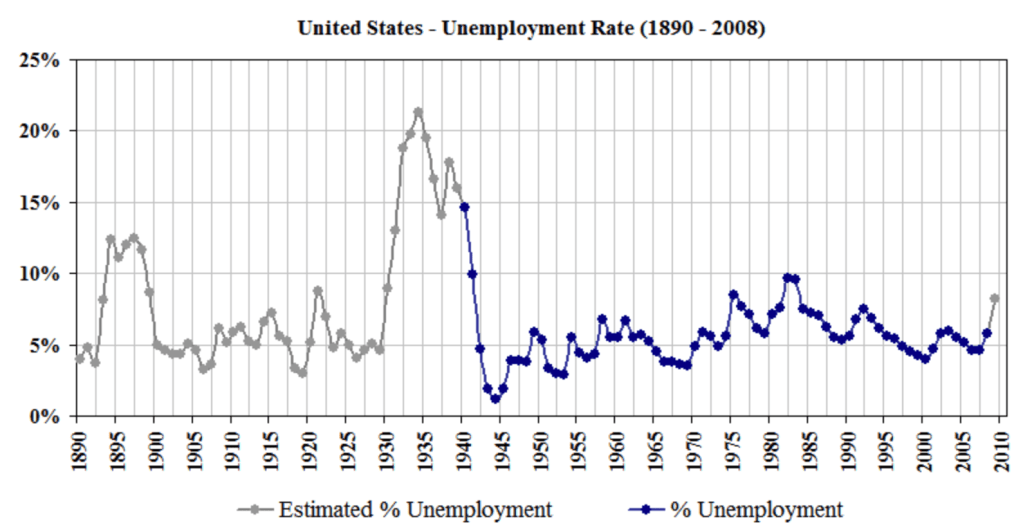

This plot – found here – shows US unemployment since 1890…

As a fallout from the Great Depression, unemployment was over 15% for nearly a decade.

Many analysts predict that the unemployment rate from COVID-19 will match or surpass those seen during the peak of the Great Depression. From Reuters just yesterday…

… new economic forecasts see U.S. unemployment not just spiking to Depression-era levels in coming weeks, but remaining above a relatively high rate of 6% through the end of 2021.

Is this good? No. But 6% unemployment through 2021 is much closer to a standard recession than a depression. More importantly this is nowhere near 15%+ unemployment for 10 years. Combined this with the quick and aggressive policy response and a depression feels less and less likely, at least in my opinion.

One might wonder how much power the Fed really has to avoid catastrophic outcomes like the Great Depression. The answer is: a lot. This essay details the role the Fed played in the Great Depression and the lessons learned since then. A concise, if simplistic, summary was offered by Ben Bernanke in 2002 at “A Conference to Honor Milton Friedman – On the Occasion of His 90th Birthday”…

“Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again.”

And, if Thursday’s Fed action is any indication – they (the central bankers) mean what they say. In the Market Minute post from mid March I quoted one oft stated rule of investing “Don’t fight the Fed.” As of this weekend the Fed is officially on wartime footing, verbally committing to “unlimited liquidity”… this is central-bank thermonuclear warfare.

Is a Great Depression like market decline still possible? Of course – anything is possible. But I always find it harder to be negative when everyone is negative. Every pundit I listen to is calling for a retest of the March 23rd low, many think that low will be taken out entirely. When everyone in a market place is anticipating something, you should expect the opposite outcome.

Even after this 20% rally from the bottom – with the Fed at the market’s back and the news-flow certain to improve – it’s very difficult to justify a short position here unless the belief is that the long-term consequences of COVID-19 will be truly catastrophic.

Given what we know in early April I’m officially optimistic.